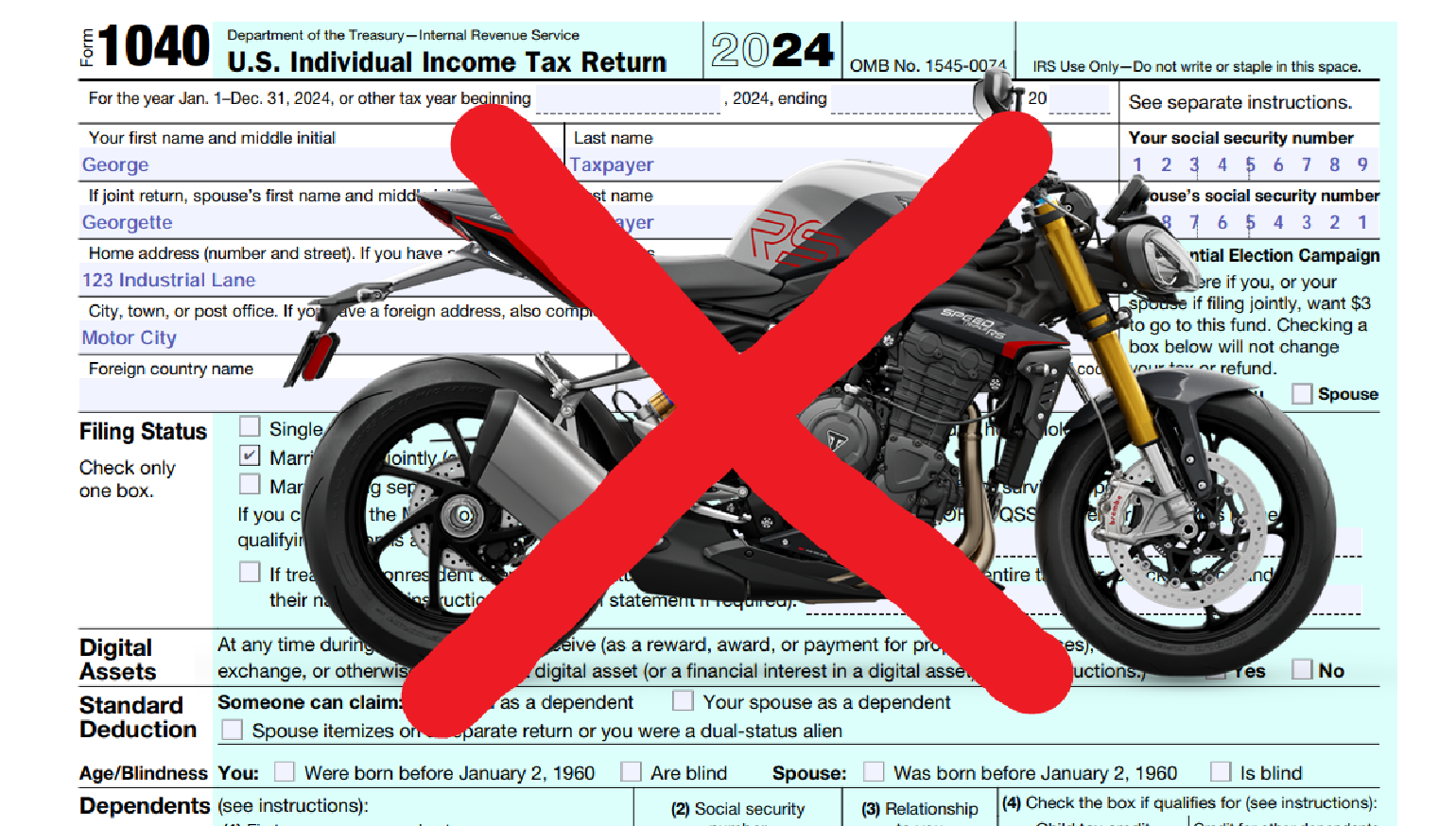

Despite all the news coverage of the "One big beautiful bill" that President Trump was able to get through Congress by the narrowest of margins, you may not have heard that the hundreds of pages of legislation include a tax break for people buying a new motorcycle. Well, for some people. There's a catch. Actually, several catches.

The relevant portion of the sprawling reconciliation bill is section 70203. Some of you who have been paying taxes for quite a few years, as I have, may remember when you could deduct more interest expenses from your taxable income on your federal return. Section 70203 restores one such deduction, the one for interest paid on a loan to buy a new vehicle. And the bill specifically includes new motorcycles purchased for personal use, along with cars and light trucks.

There are a few catches however.

- The "final assembly" of the vehicle must take place in the United States.

- The motorcycle must be for personal use, not commercial, and it can't have a salvage title or be purchased to be sold for scrap.

- It has to be street-legal.

- The deduction begins phasing out if your adjusted gross income on your tax return is above $100,000 a year for individuals or above $200,000 for couples filing jointly.

- The amount of the deduction is limited to $10,000. Though if I can speak frankly, if you have an annual income of no more than $100,000 and you're paying more than $10,000 a year in interest on motorcycle loans, I think you need the help of a therapist, a financial advisor, and probably a bankruptcy attorney (in roughly that order) more than you need a tax deduction. Just my non-professional opinion there.

The measure takes effect retroactively to the beginning of 2025, so if you took out a loan any time this year to buy a new Harley-Davidson, Indian, Zero, LiveWire, Janus, Arch, or other motorcycle built in the United States, you should be covered. If you went into debt to the limit to finance a Ducati Panigale V4 R, you're on your own. As always, Common Tread does not give tax advice so consult your advisor and don't blame us it if all goes sideways.

Membership

Membership