Various factions in the motorcycle industry, both in the United States and abroad, are trying to organize opposition to motorcycles being targeted in the unpredictable trade wars that have been unleashed by President Donald Trump. But so far, there's no assurance they'll have any effect.

The U.S. industry trade group, the Motorcycle Industry Council, has been trying to drum up participation in its annual Washington, D.C. lobbying effort by members, and tariffs are topic number one. The Capitol Hill Fly-In, as the MIC calls the event, is scheduled for April 7 and 8. Annually, MIC members, from local dealers to others in the industry, converge on Washington to meet with their representatives in Congress.

The MIC has been consistent and insistent in its messaging to members. "Your government relations team has consistently emphasized that tariffs are taxes paid by Americans, not by foreign governments or those who ship the products," it stated in a recent message encouraging members to visit their representatives in Congress and explain how tariffs will hurt their businesses.

The opposition is not just based in the United States, either. In addition to Canada specifically mentioning motorcycles as a target of retaliation for tariffs imposed by Trump, the European Union (EU) also targeted motorcycles from the United States, reviving tariffs that were implemented during the first Trump administration. The European Association of Motorcycle Manufacturers (ACEM) responded with a plea to keep motorcycles out of the dispute.

"Whilst we recognize the need for a balanced response to trade disputes, motorcycles should not become collateral damage in broader trade conflicts. The motorcycle industry provides high-quality manufacturing and related jobs, mobility and access to employment for millions of people and is a fundamental economic driver," said ACEM Secretary General Antonio Perlot, adding that "nobody wins in trade wars."

It's questionable what leverage groups like the MIC and ACEM have, however, and whether visits with members of Congress and calmly worded statements can have any effect. Few Republicans in Congress so far have pushed back at all on Trump's agenda and Democrats don't have the ability to stop him. And other countries will inevitably respond to Trump's tariffs with measures of their own.

With Trump threatening, then delaying, then changing tariffs, and now saying that more are coming on April 2, the uncertainty makes it even harder for companies to plan ahead. Bob Mack, Chief Financial Officer for Polaris, the parent company of Indian Motorcycles, said recently at a presentation for investors and financial analysts that the company has a team working full-time exclusively on the issue. Mack said during the presentation, "I was looking at my phone before I walked up here and there's been like three new crazy announcements that we're trying to parse out, between Europe, and Canada, and retaliatory, and what's going to be where."

It's not just motorcycles

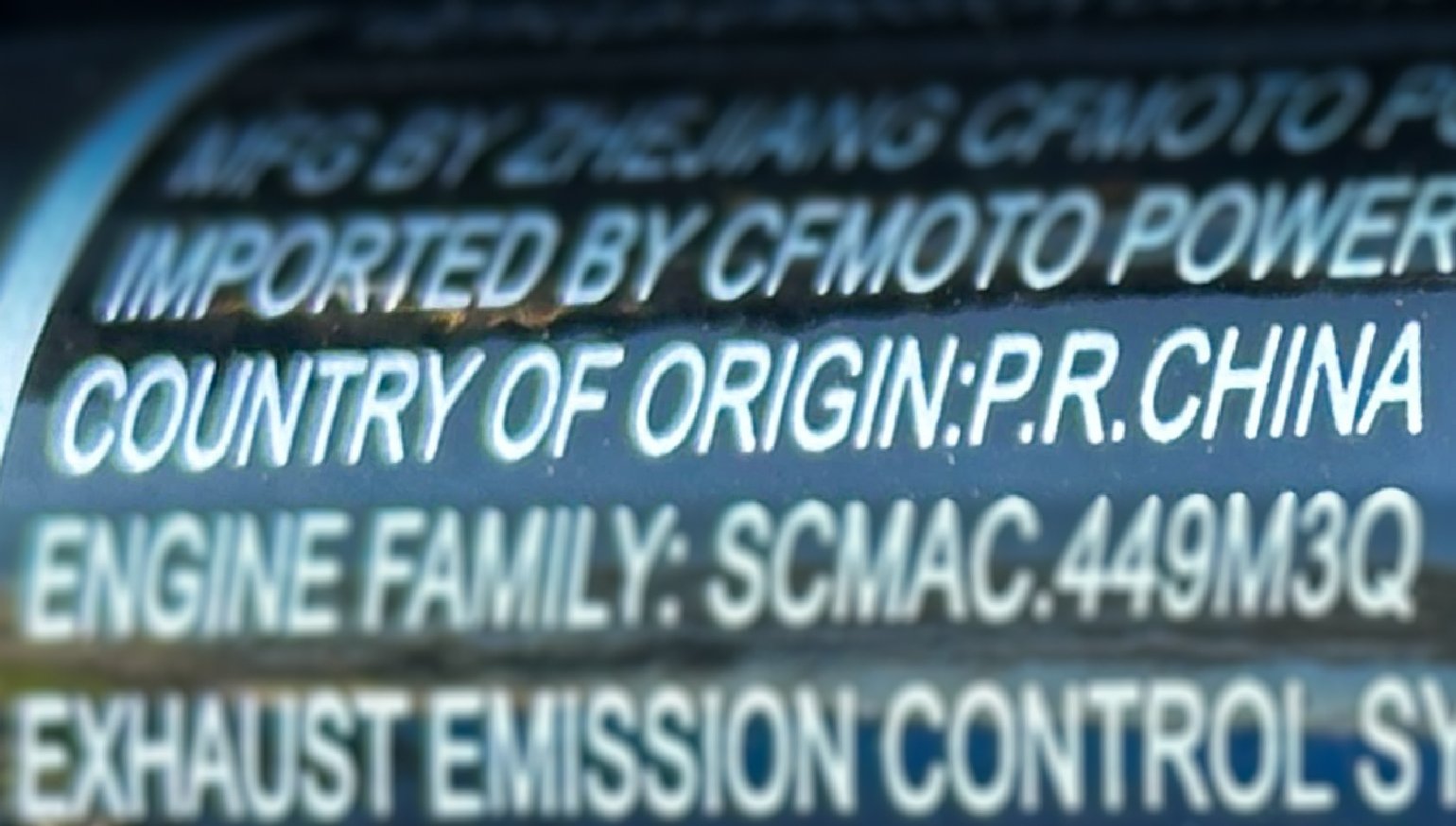

The idea of a 50% markup on the price of a new Harley-Davidson in Belgium or Spain may be the most vivid example of tariffs affecting the motorcycle industry, but the true impact is much broader, largely because so many supply chains for parts, gear, and accessories wind through China, another specific target of Trump's tariffs. Of course the president's end goal is to move more manufacturing back to the United States, but that won't happen quickly.

At Polaris, Mack said the company has been diversifying its supply chains and trying to source more items outside of China since 2018, the first round of Trump tariffs. That process was interrupted by the pandemic, he said, but has resumed now. Still, Polaris sources about $500 million in items from China.

"These supply chains have been built over decades. It's not that easy to unwind them," Mack said. "It's not that simple to just move it."

The uncertainty caused by tariffs is layered on top of stagnant sales in the U.S. motorcycle market, impacted by lingering inflation, higher interest rates than in recent years, and resulting high levels of consumer debt. Speaking at the same conference, Polaris CEO Mike Speetzen said the company is focusing on managing costs, paying down debt, helping dealers work through their high levels of inventory, and, for investors, maintaining its dividend, all in the face of the industry's headwinds.

"There's been a lot of fallout from this," Speetzen said. "When you look at the number of competitors who are exiting categories, shutting down completely, or have filed for bankruptcy and gone through that process, it's a bit staggering. I like to look at how we're positioning the company as we are the best house in a recovering neighborhood."

Right now, the motorcycle industry is trying to hold on to its status as a recovering neighborhood and not one where someone says, "Well, there goes the neighborhood."

Membership

Membership