Get ready motorcycle world. I predict electric two-wheelers will take three to five percent of new U.S. motorcycle sales over the next five to 10 years.

I know some of you are already thinking, “Yeah, yeah — I’ve heard this one before,” only to see Brammo’s batteries die and Mission Motorcycles excite Jay Leno then power down into bankruptcy. But now there are new players and shifting dynamics in the motorcycle industry. Here's why I think the e-moto story is different this time.

Reason one: The U.S. motorcycle market is ready for it

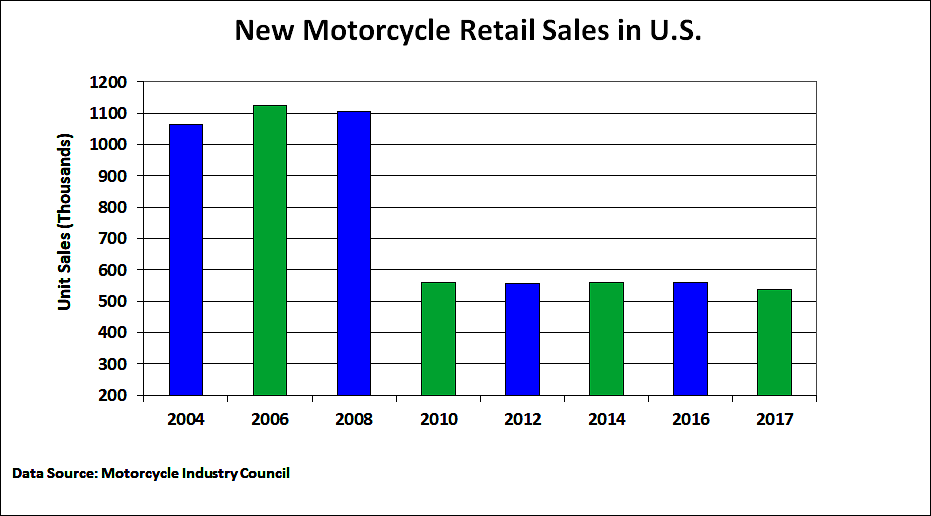

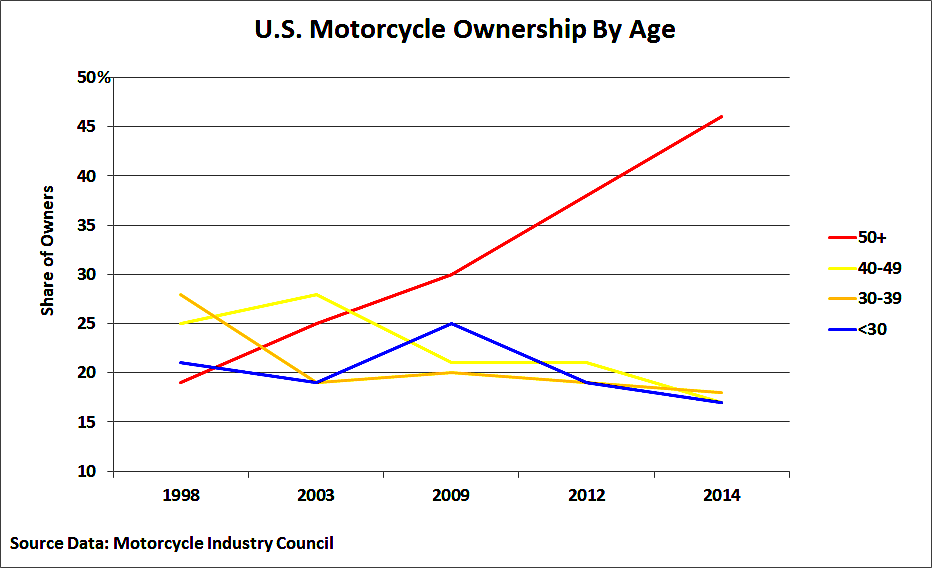

From a business perspective, the U.S. motorcycle industry has been in pretty bad shape since the recession. New bike sales dropped roughly 50 percent since 2008, with sharp declines in ownership by everyone under 40. Motorcycle manufacturers are now largely competing for an aging and shrinking American buying demographic.

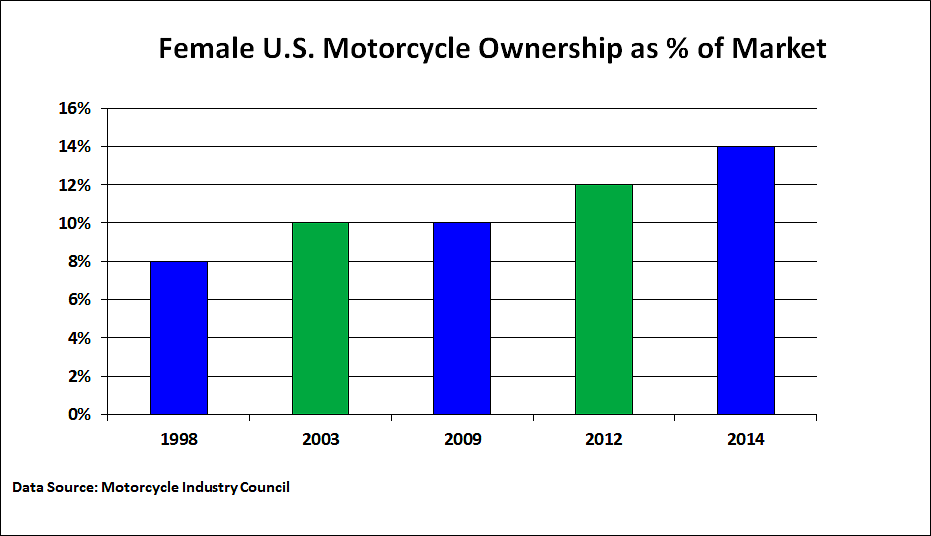

It’s not all doom and gloom, however. Two positive spots in the U.S. motorcycle market are women and resales. Females are one of the only growing ownership market segments. And per an Insurance Institute for Highway Safety study, total motorcycles on the road actually increased from 2008 to 2017 — though nearly 75 percent of registrations are for bikes over seven years old.

So Americans are buying motorcycles. Just not new ones.

A key takeaway here: Despite all the great bikes manufacturers are making, they’re not connecting with younger Americans. E-motorcycles, with their smartphone-compatible features, lower maintenance demands and easier to ride status, could become the industry's answer to attracting younger buyers and keeping up the momentum of growing sales to women.

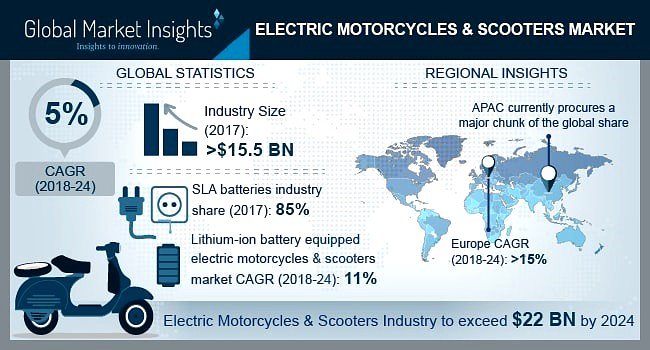

Where do U.S. e-motorcycle sales stand right now? That’s actually hard to track down. The Motorcycle Industry Council doesn’t yet collect data and in a recent Global Market Insight (GMI) study, numbers for e-moto and e-scooters are combined.

TechNavio tallies 2017 U.S. e-motorcycle sales at 4,380. If we add and divide that by MIC’s numbers, e-motos made up an estimated one percent of new motorcycles purchased in the United States last year.

Sales of electric two-wheelers have already taken off elsewhere in the world. GMI projects global electric motorcycle and scooter sales to exceed $24 billion by 2024.

Reason two: New players in the electric game

Powering my projection are three e-moto startups with significant R&D capabilities — and roughly $140 million of venture capital — that have revved up promotion and distribution in the United States.

Italy’s Energica and California-based Alta Motors and Zero Motorcycles are on a mission to pull existing riders from gas to electric and create new motorcyclists among those who may find EVs alluring.

Energica is targeting the high-performance, higher priced superbike segment, which means it will have to attract current riders of high-performance internal-combustion motorcycles — a goal the CEO confirmed in an interview earlier this year — and not just draw new riders. The company benefits from its connection to the CRP Group, which develops Formula 1 technology, and was selected as class bike for FIM’s new MotoE World Cup series, which starts next year in conjunction with MotoGP.

Alta Motors focuses primarily on electric-powered off-road machines, with four of its five models specialized for dirt riding and motocross racing.

I visited each company and met with their CEOs earlier this year. All three are boosting U.S. marketing, dealers (Zero has 100 and Alta 68), and opening up opportunities for people to test their bikes. Each has also focused business and R&D activities to close gaps with gas bikes on price, performance, weight, recharge times, and ride distance.

Reason three: Harley-Davidson's entry

Harley-Davidson could be the forerunner of an e-moto industry shift. While large manufacturers of internal-combustion motorcycles have mostly dabbled in the arena by showing EV concepts, H-D jolted the two-wheel world in January when it committed to selling a production version of its Project LiveWire electric concept bike by August 2019. Last month, Harley Davidson CEO Matt Levatich followed that up with commitments to offer additional EV models by 2022.

A combination of competitive pressure from EV upstarts and America’s number one motorcycle seller going all in on electric — along with shifting consumer preferences and regulatory tailwinds — could hasten the industry’s move to produce e-motos.

Reason four: The riding experience

For all the industry analysis and data, the number one reason I believe e-motorcycles will gain three to five percent market share in the next five to 10 years is the rider experience they provide. I base this somewhat arbitrarily on my own observation. After riding gas bikes going back to age nine, I went electric for the first time this year, testing five Alta, Energica, and Zero models on and off-road. My expectations were that I would like the electric experience for about 20 minutes, then miss clutch, gears, noise, and piston-popping power.

That didn’t happen. At first twist of the grip on Energica’s 145-horsepower EGO, I was hooked.

Given the bike’s baseline excellent design and handling, the most distinct difference from gas was power delivery. With 145 foot-pounds of torque and no clutch, gears, or carburetion between throttle commands and the rear wheel, it was the most direct acceleration I’ve ever felt on a motorcycle — something akin to striking a lightning bolt to the pavement.

These power delivery characteristics were similar on Alta’s Redshift MXR (off-road) and with Zero’s SR and FXS ZF7.2. It felt like always being in the right gear, with no interruption in the flow of power from shifting. That kind of acceleration is exhilarating and addictive, and at the end of each ride I wanted more.

I’ve been hopping between gas and electric bikes all spring and summer. Don’t get me wrong, I still love petrol-powered machines. But I’m convinced the more new and veteran riders straddle one of these top e-motorcycles, the more converts there’ll be.

Add that to all data and analysis mentioned above — including Harley-Davidson selling EVs across part of the company's huge dealer network — and the result will be more e-motorcycle market share in the U.S.A.

Membership

Membership